As we delve into the world of cryptocurrency, one of the most striking characteristics we encounter is price volatility. Unlike traditional financial markets, where price fluctuations tend to be more subdued, cryptocurrencies often experience dramatic swings in value over short periods. This volatility can be attributed to several factors, including market speculation, regulatory news, technological advancements, and macroeconomic trends.

Understanding these elements is crucial for anyone looking to navigate the crypto landscape effectively. The nature of cryptocurrency itself contributes significantly to its volatility. Many cryptocurrencies have relatively low market capitalizations compared to established assets like stocks or commodities.

This means that even small trades can lead to significant price changes. Additionally, the decentralized nature of cryptocurrencies means that they are less influenced by central banks and government policies, which can lead to unpredictable market behavior. As we explore this volatility, we must recognize both the risks and opportunities it presents for investors and traders alike.

Key Takeaways

- Cryptocurrency price volatility is a common occurrence and can be influenced by various factors such as market sentiment and news events.

- Strategies for managing cryptocurrency price volatility include setting stop-loss orders, dollar-cost averaging, and using stablecoins as a hedge.

- Utilizing technical analysis, such as chart patterns and indicators, can help navigate cryptocurrency price volatility and make informed trading decisions.

- Diversifying your cryptocurrency portfolio with a mix of different assets can help mitigate the impact of price volatility on your overall investment.

- Setting realistic expectations for cryptocurrency price volatility is important, as it can help avoid emotional decision-making and panic selling during market fluctuations.

Strategies for Managing Cryptocurrency Price Volatility

Dollar-Cost Averaging

One common approach is dollar-cost averaging (DCA), where we invest a fixed amount of money at regular intervals, regardless of the asset’s price. This strategy allows us to mitigate the impact of price fluctuations over time, as we buy more coins when prices are low and fewer when prices are high.

Stop-Loss Strategy

By setting stop-loss orders, which automatically sell our assets when they reach a predetermined price, we can limit potential losses during market downturns. However, we must be cautious with this approach, as it can also lead to selling during temporary dips, missing out on potential recoveries.

Combining Strategies for Success

By combining these strategies with a clear understanding of our investment objectives, we can better navigate the turbulent waters of cryptocurrency price volatility.

Utilizing Technical Analysis to Navigate Cryptocurrency Price Volatility

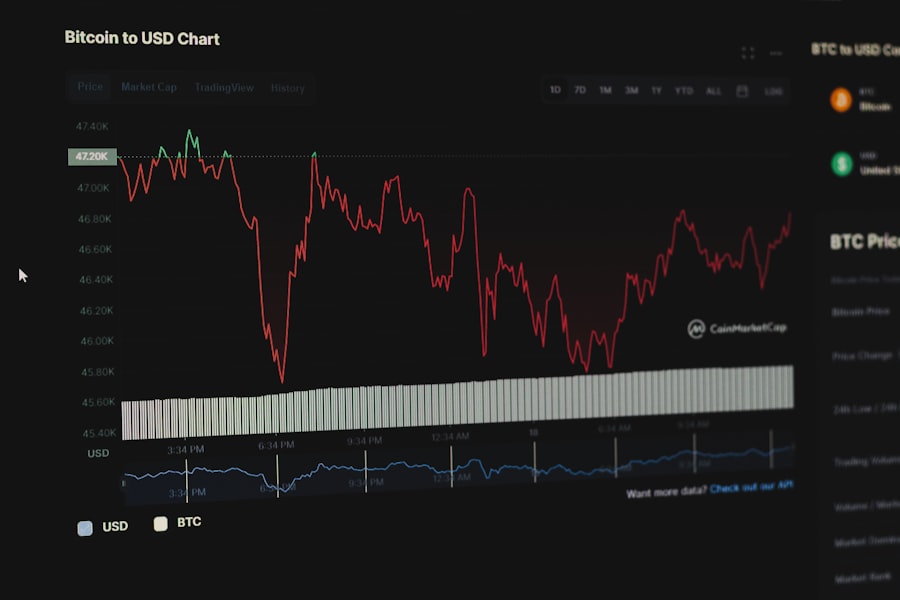

Technical analysis is a powerful tool that we can employ to make informed decisions in the face of cryptocurrency price volatility. By studying historical price movements and trading volumes, we can identify patterns and trends that may indicate future price behavior. Various indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, can provide valuable insights into market sentiment and potential entry or exit points for our trades.

Moreover, chart patterns like head and shoulders or double tops can signal potential reversals or continuations in price trends. By honing our skills in technical analysis, we can develop a more systematic approach to trading cryptocurrencies, allowing us to make decisions based on data rather than emotions. However, it is essential to remember that no analysis method is foolproof; thus, we should always remain adaptable and open to new information as we navigate this dynamic market.

Diversifying Your Cryptocurrency Portfolio to Mitigate Price Volatility

| Asset | Allocation | Volatility |

|---|---|---|

| Bitcoin | 30% | High |

| Ethereum | 20% | High |

| Ripple | 15% | Medium |

| Litecoin | 10% | Medium |

| Stellar | 10% | Low |

| Other Altcoins | 15% | High |

Diversification is a fundamental principle in investing that holds true even in the realm of cryptocurrencies. By spreading our investments across various digital assets, we can reduce the overall risk associated with price volatility. Instead of putting all our funds into a single cryptocurrency, we can allocate our resources among established coins like Bitcoin and Ethereum, as well as promising altcoins with strong fundamentals.

This strategy not only helps us mitigate risk but also positions us to capitalize on different market trends. For instance, while one asset may be experiencing a downturn, another could be on the rise. By maintaining a well-diversified portfolio, we can cushion ourselves against the inevitable ups and downs of the cryptocurrency market.

Additionally, regularly reviewing and rebalancing our portfolio ensures that we remain aligned with our investment goals and risk tolerance.

Setting Realistic Expectations for Cryptocurrency Price Volatility

In the world of cryptocurrency, setting realistic expectations is crucial for maintaining a healthy investment mindset. While it is tempting to chase after astronomical returns often touted in media headlines, we must remind ourselves that such gains are not guaranteed and often come with significant risks. Understanding that price volatility is a natural part of the crypto landscape allows us to approach our investments with a more balanced perspective.

We should also consider the long-term potential of our investments rather than focusing solely on short-term price movements. By adopting a long-term view, we can better withstand the inevitable fluctuations and avoid making impulsive decisions based on fear or greed. Establishing clear goals and timelines for our investments can help us stay grounded and focused on what truly matters in our cryptocurrency journey.

The Role of Market Sentiment in Cryptocurrency Price Volatility

Market sentiment plays a pivotal role in driving cryptocurrency price volatility. The collective emotions and perceptions of investors can lead to rapid price changes based on news events, social media trends, or influential figures within the crypto community. For instance, a tweet from a prominent figure can send prices soaring or plummeting within minutes, highlighting how sentiment-driven trading can create significant volatility.

To navigate this aspect of the market effectively, we must stay informed about current events and trends that may impact investor sentiment.

By understanding how sentiment influences price movements, we can make more informed decisions and potentially capitalize on opportunities that arise from shifts in market perception.

Risk Management Techniques for Dealing with Cryptocurrency Price Volatility

Effective risk management is essential for anyone involved in cryptocurrency trading or investing. One technique we can employ is position sizing, which involves determining how much capital to allocate to each trade based on our overall portfolio size and risk tolerance. By limiting the amount we invest in any single trade, we can protect ourselves from significant losses during periods of high volatility.

Another important aspect of risk management is maintaining an emergency fund or cash reserve. This allows us to weather market downturns without being forced to sell our assets at unfavorable prices. Additionally, employing trailing stop orders can help us lock in profits while still allowing for potential upside as prices rise.

By implementing these risk management techniques, we can navigate the unpredictable nature of cryptocurrency markets with greater confidence.

Short-term trading often involves capitalizing on rapid price movements through techniques like day trading or swing trading. While this approach can yield quick profits, it also requires significant time commitment and carries higher risks due to market unpredictability.

On the other hand, a long-term investment strategy focuses on holding assets for extended periods, allowing us to ride out short-term fluctuations while benefiting from potential long-term growth. This approach often aligns better with those who prefer a more hands-off investment style and are willing to endure volatility for the sake of future gains. Ultimately, the choice between long-term and short-term strategies depends on our individual preferences and financial objectives.

In conclusion, navigating cryptocurrency price volatility requires a multifaceted approach that combines understanding market dynamics with effective strategies for managing risk and expectations. By employing techniques such as technical analysis, diversification, and sound risk management practices, we can position ourselves for success in this ever-evolving landscape. Whether we choose to adopt a long-term or short-term perspective, staying informed and adaptable will be key as we journey through the exciting world of cryptocurrencies together.

FAQs

What is cryptocurrency price volatility?

Cryptocurrency price volatility refers to the rapid and significant changes in the value of cryptocurrencies over a short period of time. This can result in large price fluctuations, making it difficult to predict the future value of a cryptocurrency.

What causes cryptocurrency price volatility?

Cryptocurrency price volatility can be caused by a variety of factors, including market demand and supply, regulatory changes, technological developments, and market sentiment. Additionally, the relatively small market size and lack of regulation can contribute to increased volatility in the cryptocurrency market.

How does cryptocurrency price volatility affect investors?

Cryptocurrency price volatility can have a significant impact on investors, as it can lead to both substantial gains and losses in a short period of time. Investors may experience increased risk and uncertainty when trading or holding cryptocurrencies due to their volatile nature.

Can cryptocurrency price volatility be mitigated?

While it is difficult to completely eliminate cryptocurrency price volatility, investors can take steps to mitigate its impact. This includes diversifying their investment portfolio, conducting thorough research, and using risk management strategies such as stop-loss orders.

Is cryptocurrency price volatility unique to the cryptocurrency market?

While all financial markets experience some level of price volatility, the cryptocurrency market is known for its particularly high levels of volatility. This is due to the market’s relative immaturity, lack of regulation, and the influence of speculative trading.

Get more stuff like this

Subscribe to our mailing list and get interesting stuff and updates to your email inbox.

Thank you for subscribing.

Something went wrong.