In the rapidly evolving world of digital finance, cryptocurrency exchanges serve as the vital platforms that facilitate the buying, selling, and trading of various cryptocurrencies. These exchanges act as intermediaries, connecting buyers and sellers in a marketplace that operates 24/7. By providing a user-friendly interface, they allow us to navigate the often complex landscape of digital currencies with relative ease.

Understanding how these exchanges function is crucial for anyone looking to engage in cryptocurrency trading, as they play a pivotal role in determining our trading experience and success. Cryptocurrency exchanges can be broadly categorized into two types: centralized and decentralized exchanges. Centralized exchanges, such as Coinbase and Binance, are operated by companies that manage the platform and hold users’ funds.

This model offers convenience and liquidity but also introduces risks related to security and regulatory compliance. On the other hand, decentralized exchanges (DEXs) like Uniswap and SushiSwap operate without a central authority, allowing users to trade directly with one another. While DEXs provide greater privacy and control over funds, they can be less user-friendly and may lack the same level of liquidity as their centralized counterparts.

By understanding these distinctions, we can make informed decisions about where to trade our cryptocurrencies.

Key Takeaways

- Cryptocurrency exchanges are platforms where you can buy, sell, and trade digital currencies.

- When choosing a cryptocurrency exchange, consider factors such as security, fees, available cryptocurrencies, and user interface.

- Setting up an account on a cryptocurrency exchange typically involves providing personal information, verifying your identity, and setting up two-factor authentication for security.

- Depositing and withdrawing funds on a cryptocurrency exchange can be done through bank transfers, credit/debit cards, or other cryptocurrencies.

- When trading cryptocurrencies, it’s important to understand market orders, limit orders, and stop orders to make informed decisions.

Choosing the Right Cryptocurrency Exchange

Selecting the right cryptocurrency exchange is a critical step in our trading journey. With numerous options available, we must consider several factors to ensure that we choose a platform that aligns with our needs and preferences. One of the first aspects to evaluate is the range of cryptocurrencies offered by the exchange.

Some platforms focus on popular coins like Bitcoin and Ethereum, while others provide access to a wider array of altcoins. Depending on our investment strategy, we may want to choose an exchange that supports the specific cryptocurrencies we are interested in trading. Another important consideration is the user experience provided by the exchange.

A well-designed interface can significantly enhance our trading experience, making it easier for us to execute trades and monitor our portfolio. We should also look for features such as advanced trading tools, mobile applications, and customer support options. Additionally, we must assess the exchange’s reputation within the cryptocurrency community.

Reading reviews and seeking feedback from other users can help us gauge the reliability and trustworthiness of a platform before committing our funds.

Setting Up Your Account

Once we have chosen a cryptocurrency exchange that meets our criteria, the next step is to set up our account. This process typically begins with providing our email address and creating a secure password. Many exchanges also require us to verify our identity to comply with regulatory standards.

This verification process may involve submitting personal information, such as our name, address, and a government-issued ID. While this step may seem cumbersome, it is essential for ensuring the security of our account and preventing fraudulent activities. After completing the verification process, we can proceed to configure our account settings.

This may include enabling two-factor authentication (2FA) for added security, setting up withdrawal limits, and customizing notification preferences. Taking the time to properly set up our account can help us manage our trading activities more effectively and safeguard our investments against potential threats. As we familiarize ourselves with the platform’s features, we should also explore any educational resources or tutorials offered by the exchange to enhance our understanding of its functionalities.

Depositing and Withdrawing Funds

| Metrics | Depositing Funds | Withdrawing Funds |

|---|---|---|

| Processing Time | Instant | 1-3 business days |

| Minimum Amount | 10 | 20 |

| Maximum Amount | 1000 | 5000 |

| Fees | Free | 5 per transaction |

With our account set up, we are now ready to deposit funds into our cryptocurrency exchange account. Most exchanges offer multiple deposit options, including bank transfers, credit or debit card payments, and even cryptocurrency deposits from external wallets. Each method comes with its own set of advantages and disadvantages in terms of speed, fees, and convenience.

For instance, bank transfers may take longer to process but often incur lower fees compared to credit card transactions. We should carefully evaluate these options based on our urgency and financial situation. When it comes to withdrawing funds from our exchange account, we must be aware of the procedures involved.

Withdrawals typically require us to specify the amount we wish to withdraw and the destination wallet address if we are transferring cryptocurrencies. It is crucial to double-check this information to avoid any potential loss of funds due to incorrect addresses. Additionally, we should familiarize ourselves with any withdrawal limits imposed by the exchange, as well as any associated fees.

Understanding these processes will help us manage our funds more effectively and ensure a smooth experience when moving money in and out of our accounts.

Trading Cryptocurrencies

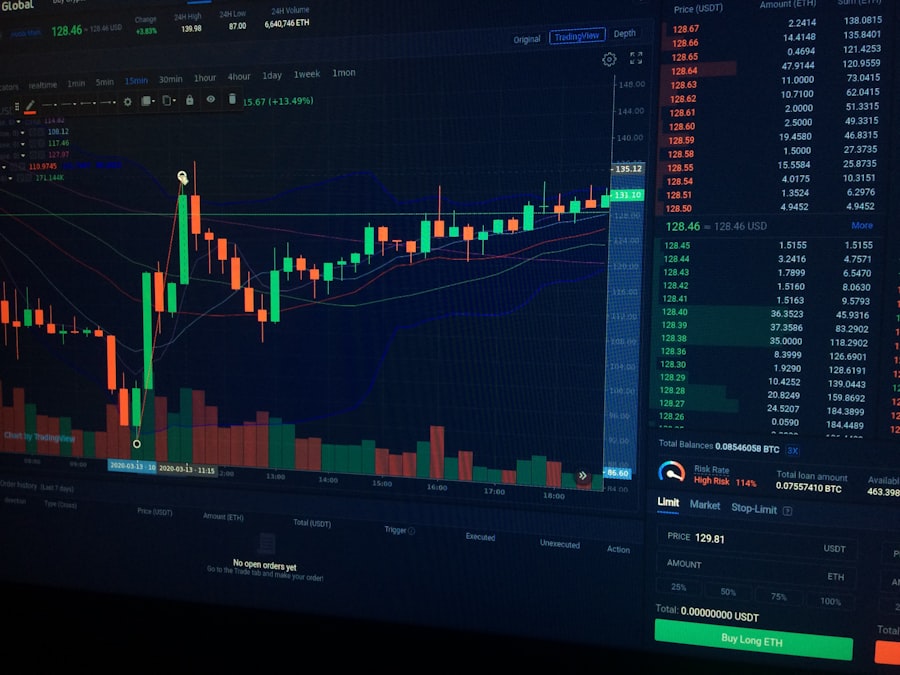

Now that we have funded our account, we can dive into the exciting world of cryptocurrency trading. The trading process generally involves selecting a trading pair—such as Bitcoin to Ethereum—and deciding whether we want to buy or sell based on market conditions. Most exchanges provide various order types, including market orders, limit orders, and stop-loss orders, each serving different purposes depending on our trading strategy.

By understanding these order types, we can execute trades more effectively and manage our risk exposure. As we begin trading, it is essential to stay informed about market trends and developments that could impact cryptocurrency prices. Utilizing technical analysis tools and charting software can help us identify potential entry and exit points for our trades.

Additionally, keeping an eye on news related to regulatory changes or technological advancements in the crypto space can provide valuable insights into market sentiment. By combining research with strategic trading practices, we can enhance our chances of making profitable trades while minimizing potential losses.

Security Measures and Best Practices

Secure Storage Methods

One of the most effective ways to safeguard our cryptocurrencies is by using hardware wallets or cold storage solutions for long-term holdings. These devices store our private keys offline, making them less vulnerable to online threats compared to keeping them on an exchange.

Good Online Hygiene

In addition to using secure storage methods, we should also practice good online hygiene by regularly updating our passwords and enabling two-factor authentication (2FA) on all accounts associated with cryptocurrency trading. Being cautious about phishing attempts is equally important; we must be vigilant when clicking on links or providing personal information online.

Reducing the Risk of Cyberattacks

By implementing these best practices, we can significantly reduce the risk of falling victim to cyberattacks and ensure that our investments remain safe.

Understanding Fees and Charges

As we engage in cryptocurrency trading, it is essential for us to understand the various fees and charges associated with using an exchange. Most platforms charge trading fees based on a percentage of the transaction amount or a flat fee per trade. Additionally, there may be deposit and withdrawal fees that vary depending on the payment method used.

Familiarizing ourselves with these costs will help us calculate potential profits accurately and avoid unexpected expenses. Some exchanges also offer tiered fee structures based on trading volume or membership levels, which can provide opportunities for cost savings if we trade frequently or in larger amounts. It is wise for us to compare fee structures across different exchanges before making a decision on where to trade.

By being aware of these fees upfront, we can make more informed choices about our trading activities and maximize our returns.

Resources for Further Learning

As we continue our journey into cryptocurrency trading, it is vital for us to seek out resources that can enhance our knowledge and skills in this dynamic field. Numerous online platforms offer educational materials ranging from beginner guides to advanced trading strategies. Websites like CoinMarketCap and Investopedia provide valuable insights into market trends, while forums such as Reddit’s r/CryptoCurrency allow us to engage with other traders and share experiences.

Additionally, many exchanges offer their own educational resources through blogs, webinars, and tutorials designed to help users navigate their platforms effectively.

By committing ourselves to continuous learning, we can adapt to changes in this fast-paced environment and position ourselves for success in the world of cryptocurrency trading.

In conclusion, navigating the world of cryptocurrency exchanges requires careful consideration at every step—from understanding how exchanges operate to implementing security measures that protect our investments. By choosing the right platform, setting up our accounts securely, managing deposits and withdrawals effectively, engaging in informed trading practices, understanding fees, and utilizing available resources for learning, we can enhance our overall experience in this exciting financial landscape. As we embark on this journey together, let us remain vigilant and proactive in expanding our knowledge while embracing the opportunities that cryptocurrency trading presents.

FAQs

What is a cryptocurrency exchange?

A cryptocurrency exchange is a platform that allows users to buy, sell, and trade cryptocurrencies. It acts as an intermediary between buyers and sellers and provides a marketplace for various digital assets.

How do cryptocurrency exchanges work?

Cryptocurrency exchanges work by matching buy and sell orders from their users. When a buyer and seller agree on a price, the exchange facilitates the transaction and charges a fee for its services.

What are the different types of cryptocurrency exchanges?

There are several types of cryptocurrency exchanges, including centralized exchanges (CEX), decentralized exchanges (DEX), and peer-to-peer (P2P) exchanges. Each type has its own unique features and benefits.

What are the risks of using cryptocurrency exchanges?

Some of the risks associated with using cryptocurrency exchanges include security breaches, hacking attacks, regulatory issues, and market volatility. Users should carefully research and choose a reputable exchange to mitigate these risks.

How can I choose the right cryptocurrency exchange?

When choosing a cryptocurrency exchange, consider factors such as security measures, user interface, trading fees, supported cryptocurrencies, customer support, and regulatory compliance. It’s important to conduct thorough research and read reviews before selecting an exchange.

Get more stuff like this

Subscribe to our mailing list and get interesting stuff and updates to your email inbox.

Thank you for subscribing.

Something went wrong.